Is Bitcoin Real Money?

Mar 4, 2021

Recently, Bitcoin and other cryptocurrencies seem to be gaining a lot of attention. Bitcoin was the first to appear, and it has attracted economists, technologists, entrepreneurs, politicians, activists, libertarians, and the list goes on. Some people love it, and others seem to hate it. But why?

Is Bitcoin real money, or is it just another fancy toy for nerds? I will try to answer this question and, in the process, explain to you what Bitcoin is and how does it work.

Bitcoin has unique economic and technological characteristics that make it special. From an economics standpoint, it claims to be noninflationary–due to a controlled supply. On the technology side, it introduced what we now know as the blockchain–a digital ledger that's unforgeable. We'll get into much more detail next.

Mo Money, Mo Problems

A good place to start our discussion is to ask ourselves: what is money? The common answer is that money is what we use to buy things: TVs, phones, food, clothing, etc.–or to pay for services, such as electricity, internet access, house repairs, teeth cleaning, etc. And, that's correct. Money is a medium of exchange for goods and services, but let's dig a little deeper. What gives value to the pieces of paper we call money? It seems that many people, either don't know or have the wrong answer to this question.

For something to be used as money or currency, it has to have some special characteristics. Money needs to be unforgeable, portable, and universally verifiable. We have to be able to use money as a unit of account and price things in it. It has to be rare or difficult to make. You can't use seashells as currency if you live by the shore.

For these reasons, societies throughout history used precious metals, such as bronze, gold, or silver, as currency. We know the Aztecs used cocoa beans as a form of currency because they were considered valuable. Actually, people living in the mountains–where it's difficult to obtain them–would use seashells as currency. In more recent history, gold was the currency throughout Europe, the United States, and other countries. This monetary system is known as the gold standard.

But, because gold is too heavy, it became inconvenient to carry around in large quantities. As we mentioned earlier, money needs to be portable. So, although this sounds like a nice problem to have, governments introduced paper money. These were gold certificates, and they were redeemable for a given amount of gold. For every paper certificate, a corresponding physical amount of gold was in store.

The picture below is a US gold certificate from 1922. Notice the legend on top "there have been deposited in", and in the bottom "repayable to the bearer on demand".

US gold certificate from 1922 (Public domain).

After the great depression of 1929, the US and other countries started to abandon the gold standard. Paper money was no longer backed by gold, so it became fiat money.

Your Money is Like Tinker Bell

Modern fiat currencies, such as the dollar or the euro, are only a promise of value. This value is promised by the government that issues the note. It only has value because we all believe that it has. We are, collectively, the ones that give value to money. Like the character Tinker Bell the fairy, money's value only exists if we believe in it. Another good analogy would be Santa Claus (sorry kids) or choosing the blue pill from Morpheus in the movie The Matrix.

As a thought experiment, imagine that one day, businesses decide they no longer accept dollars as currency. For the purpose of the experiment, we are assuming you live in the US (but it could be any other country and local currency). The only accepted currency now is the Chinese yuan (this can also be any other currency, as long as it's different from the first one we chose). In that scenario, your dollars are just worthless pieces of paper. The only reason they had any value was that those businesses believed they did, and they were willing to exchange their services or goods for those pieces of paper.

It's doubtful (though not impossible) something like that could happen with precious metal, such as gold. Given that gold exists in limited quantities and that it's difficult to obtain, it has an intrinsic value.

Where Did My Money Go?

Paper money, on the other hand, can be created in unlimited quantities. Governments can simply print more bills (following their monetary policies, which of course, they define themselves). This creates problems for the value of money. An extra supply of paper money generates inflation, meaning that the value of money is depreciated. The reason is that the new money is not backed by anything tangible–like gold or another commodity–and there's more of it.

Governments report the inflation rate for the year, for example, a 5% inflation rate. This means that your money is now worth 5% less. You now need to use more of those pieces of paper to pay for the same thing than you did in the previous year. If the inflation rate stays at this number, your money will be worth half its present value in ten years.

After World War I, during the Weimar Republic years, Germany experienced a period of hyperinflation. The reichsmark–as the currency was called at the time–was so worthless that Expressionist artists would use them as a canvas for their paintings.1

Inflation de-incentivizes people from saving money. Why would you save money, knowing that its purchasing power will be less in the future? It's certainly better to spend it now when it has more value.2 This is what economists call high time preference, psychologists call it instant gratification. The opposite of instant gratification is, of course, delayed gratification. Some argue that delayed gratification is one of the traits that differentiates humans from other species. It requires the capacity to think ahead and plan for the future.

$$\cdot \cdot \cdot$$

So far, I've discussed what money is, some of its history, and its characteristics. Let's now switch gears and discuss Bitcoin. Before tackling our main question, I need to explain what Bitcoin is, and how does it work. After that, we'll use what we know about money to determine if Bitcoin falls in that category.

We're in the Digital Age Now

In October of 2008, the pseudonymous Satoshi Nakamoto released the Bitcoin white paper. The software implementation of this new technology followed a few months later. It seems nobody knows the true identity of Satoshi Nakamoto–it could be one person or a group of people. Satoshi's identity doesn't really matter, since the software is open-source, meaning that anyone can take a look, modify it, make improvements, use it, and re-distribute it freely.

Bitcoin is a digital currency based on cryptography, math, game theory, and computer science. It allows us to use digital "money" as cash, without the need for third parties. If Alice wants to send Bitcoin to Bob, she can do it directly through a P2P (peer-to-peer) network connection–without having to pay any fees to her bank or credit card company.

An important aspect of Bitcoin–and financial transactions in general–is keeping information secure. And, since these transactions are carried over a globally distributed network–i.e. the internet–we require that they are reliable, correct, and trustworthy. Bitcoin technology addresses these issues using a combination of the disciplines I mentioned above.

In the Bitcoin network, there's no central authority. The system is kept by the participating users or nodes. These nodes accept or reject every transaction through a consensus algorithm. Then a digital ledger called the blockchain keeps a record of every transaction. Everyone can access and verify any transaction in the blockchain. There's no longer a need for "trust" if anyone can independently verify.

Crypto-who Now?

One of the key components of Bitcoin is cryptography, hence the name cryptocurrency. Cryptography is a branch of mathematics and computer science that deals with securing information using codes or ciphers. When the information is secured or encrypted, it can then be transmitted without worrying about the presence of third parties, called adversaries. The intended receiver will have a key that allows for the decryption of the original message.

We use this technology every day when shopping online or transferring money using banking apps. Our information, such as our credit card number, gets encrypted and then transmitted through the internet. Even if a malicious agent collects this information, it will be nearly impossible to decipher without the appropriate key. This form of secure data exchange is also called public-key cryptography.

Don't Lose Your Keys!

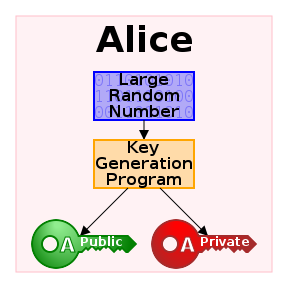

I've been mentioning needing a "key" when dealing with encrypted information. In fact, we need two keys to work with a public-key cryptography system. One is a public key, and the other is a private key–a key is nothing but a long sequence of numbers and characters. The private key is to be kept secure, while the public key can be shared with others.

The flow chart below represents user Alice's computer generating a cryptographic key pair.

Flowchart describing the process of generating a public and private key (Public domain).

This works in the following way. Let's say you want to receive an important message containing private information. First, your computer generates the key pair using a cryptographic algorithm. You then share the public key with the sender, who will use it to encrypt the information. When you receive the message, you use your private key to decrypt it. Since you are the only one who has the private key–and it only works in combination with the public key–you are the only one who can access the information.

Notice the importance of keeping the private key secured. Also, there's no need to generate a new key pair for every exchange of information. Multiple senders can use the same public key for encryption. And, only the owner of the private key will be able to access that information. However, if you lose your private key, any encrypted information becomes inaccessible. Similar to losing the combination code to a safe.

Put Your Hard Hats On

Cryptography is also an integral part of how we generate or mine new Bitcoins. Bitcoin miners have to solve a cryptographic puzzle to get a reward–in this case, a predefined amount of Bitcoin. The first one to solve the puzzle gets the prize. A winner is determined by node consensus, and all this is recorded in the blockchain.

A "puzzle" consists of finding a cryptographic hash–a large sequence of numbers–with special characteristics. A miner performs hashing operations until it finds the right combination of values that result in the target hash. This result is easily verifiable by the other nodes. Since the only way to find the correct hash is by a brute force approach, this constitutes a proof-of-work, needed for approval by the nodes in the network.

The system is designed so that every subsequent puzzle in the chain gets harder to solve. Initially, it was possible to mine Bitcoins using a personal computer. As the puzzles became harder, more computational resources and special hardware–like GPUs and ASICs–were required. Today, mostly corporations with enough resources do the mining.

A miner is a special type of node in the Bitcoin network. However, other nodes play a special role. These are in charge of verifying the transactions and keeping the records in the blockchain ledger. Anyone can run this kind of node, and since every transaction needs to be agreed upon to be valid, nobody has special authority.

Everybody Talks About the Blockchain

In the Bitcoin system, the blockchain serves as the source of truth. It's worth mentioning that it was in the Bitcoin white paper that the blockchain was first ever introduced. A feature that makes it special is that it's almost impossible to alter or forge any record. By design, the number of computational resources needed to do this is staggering. This feature discourages malicious agents from trying to alter it.

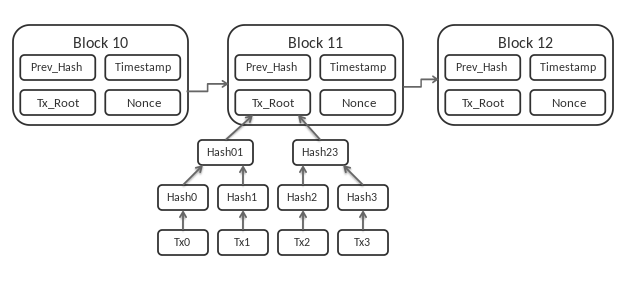

Satoshi Nakamoto created the genesis block in 2009, giving birth to the Bitcoin blockchain. A block represents a grouping of information, including transaction records, a timestamp, and a cryptographic hash. Once a block is filled out, it gets linked to the previous one and a new block is started. It's possible to access every transaction and record, all the way back to the initial block.

The diagram below depicts the structure of the blockchain. The transaction records (labeled as "TX_Root") are represented with a data structure called a Merkle tree.

Diagram of the blockchain structure (Matthäus Wander - Own work. CC BY-SA 3.0).

The blockchain is also a decentralized and distributed ledger–which makes it robust. Every node in the network keeps a copy of it. Now, in computer science, a distributed system is required to be fault-tolerant. This means that the system should continue working correctly even if some of its components fail. A Byzantine fault is a condition in which the system needs to agree on what information–coming from different nodes–is correct in order to proceed.3 As we've seen, the blockchain solves this issue by requiring validation and consensus among nodes for every transaction.

Another issue the blockchain solves is the double-spending problem. A potential flaw present in digital cash systems. This occurs when the same token is used or spent twice. Due to its digital nature, the same token can be copied multiple times. However, the blockchain prevents this from happening. Since every transaction is verified and recorded, any attempt at this is easily detected.

Lastly, the blockchain allows for the creation of smart contracts. They're written as a software program, and the system guarantees their execution. Smart contracts provide an automatic escrow service for two parties, without the need for a trusted third party. For instance, a transfer of Bitcoin from one person to another is ensured through a smart contract.

$$\cdot \cdot \cdot$$

Earlier, I discussed some of the characteristics of money and what makes it valuable. We can now move on to discuss whether Bitcoin can be considered money and what gives value to it.

If It Walks Like a Duck and It Quacks Like a Duck...4

First, let's recall the properties of money and see if Bitcoin has them. I list them below.

Money needs to be portable. This one's easy, Bitcoin can be "transported" anywhere in the world. As long as you have a phone or computer with an internet connection, you can access and use your Bitcoin anywhere.

Money must be unforgeable (or at least difficult to forge). As we saw earlier–thanks to the blockchain–it's almost impossible to make a fake Bitcoin. Every single Bitcoin comes from the mining process and recorded in the blockchain.

Money should be universally verifiable. When you receive a dollar or a euro, you should be able to recognize it–because you know what it looks like–without the need to call the bank for verification. Again, with Bitcoin, this is possible thanks to the blockchain. A Bitcoin transaction is simply not possible if it doesn't involve Bitcoin.

Money should be rare or difficult to make. As I noted earlier, scarcity is what makes things like gold more valuable. Bitcoin has this attribute as well. Recall that Bitcoin mining not only requires powerful hardware but also finding the correct hash gets increasingly harder. This, in combination with a predefined supply, make Bitcoin scarce. In fact, this is one of the revolutionary features of Bitcoin–it created digital scarcity.5

Money must allow us to price things in it–serve as a unit of account. This is a key characteristic of money that, at this point, Bitcoin doesn't have. Currently, the price of Bitcoin is highly volatile. This makes it impractical to price things in it. Some predict the price of Bitcoin will start to stabilize, but until then this is where we stand.

So we can see that Bitcoin has most of the characteristics of money. However, it still lacks the crucial property of allowing us to price things in it. As such, we can't consider Bitcoin as money–at least not traditional money.

We can't ignore the fact that there are places today that accept Bitcoin as payment. We can also go online and buy things with it. Bitcoin is being used as a medium of exchange. Isn't that what money is supposed to do?

The number of places and people using Bitcoin as money is still small–though it seems to be growing. As we know from history, societies tend to replace their currencies with "better" currency. People in Mexico no longer use cocoa beans as currency–as the Aztecs did. Whether Bitcoin becomes a mainstream currency or not, I think only time will tell.

Let's now consider what gives value to Bitcoin. As it turns out, this might be more of a philosophical question, but let's dig in.

Do You Believe?

I mentioned earlier that ever since our currencies stopped being backed by gold, their value is given by people believing in it (remember Tinker Bell). This might as well be the case for Bitcoin. But, some argue that Bitcoin is more like gold rather than traditional fiat currencies.

The reasons behind these arguments are in the properties of Bitcoin. Like gold, Bitcoin is scarce and difficult to get or "mine." Just as there's a limited amount of gold on Earth, there will only ever be 21 million Bitcoins created.6 This hard limit on the number of Bitcoins guarantees no inflation. It makes it a deflationary currency, meaning its value will increase with time.

Bitcoin is of course, different than gold in that mining is done entirely by computers. And, you can't touch or wear Bitcoins. It seems the question comes back to whether people believe in the value of Bitcoin. Some say that Bitcoin lacks an intrinsic value. Others argue that the fact that we need to spend resources to acquire it gives it value. Yet, others see it as a store of value asset.

I will let you decide on this one.

$$\cdot \cdot \cdot$$

Looking Ahead

Like any new invention, Bitcoin must be useful to people to survive. It seems adoption is growing, but it's difficult–if not impossible–to predict if it will stay or be replaced by something else in the future.

From a technical vantage point, Bitcoin is fascinating. The combination of cryptography, math, and game-theoretic rules–to create a robust distributed system of digital money–is compelling. Even more so when we consider that–for the very first time–technology like this has been successfully implemented.

Then we have the socioeconomic implications of Bitcoin. A worldwide, decentralized financial system where anyone–with an internet connection–can participate. Smart contracts let people conduct transactions–without the need for trusted third parties–from anywhere in the world.

Bitcoin technology (and all the crypto assets that spawned afterward) opened up a new paradigm in finance, called decentralized finance or DeFi. As its name suggests, in a decentralized financial system, there's no central authority. And, there's a new breed of software apps–called decentralized apps–that's emerging.

We also have things like NFTs (Non-Fungible Tokens), made possible by the blockchain. NFTs are unique digital assets whose proof of authorship and ownership are recorded in a blockchain–they're becoming increasingly popular. People are finding new uses for crypto and the blockchain.

$$\cdot \cdot \cdot$$

In his book The Black Swan, N. N. Taleb points out that many times, engineers develop tools just for the pleasure of it. And, often these tools end up being used for things that weren't thought of when they were created. As he puts it:

"We build toys. Some of those toys change the world."

Will this be the case for Bitcoin? Will Bitcoin change the world? It seems to me that is already happening.

Notes

-

For a more in-depth and fascinating narration about Weimar Germany, I recommend Before the Deluge: A Portrait of Berlin in the 1920s by Otto Friedrich. ↩

-

We can argue that saving money and investing is a good strategy. I think it is, but investing also implies risk. You can either lose or gain money. You also want the returns to be higher than the inflation rate. Money sitting by itself will lose value if inflation goes up. On the other hand, we can say that borrowing and owing money is good because the value of the debt will go down. In theory, that's correct, but remember that we have interests–and usually fees–for loans and credits. Also, please don't take this as financial advice. ↩

-

A Byzantine fault in a distributed system occurs when there might be a node or more with unreliable information, either because of a fault or malicious activity. ↩

-

The complete phrase is "If it walks like a duck, and it quacks like a duck, then it must be a duck." It refers to the concept of duck typing in computer programming languages. It's used when a program's interpreter or compiler determines the type of value or action an object can take–without this being explicitly declared in the program. This is determined by verifying if the object has certain properties (programming languages that support this kind of typing are called dynamically typed languages). ↩

-

Digital scarcity is special because it does the opposite of what digital information is supposed to do–it restricts the number of copies of a piece of information that we can make. ↩

-

Bitcoin is highly divisible. We can divide one Bitcoin up to 8 decimal places ( $10^{-8}$ ). The smallest unit of Bitcoin is called a satoshi. ↩